A comprehensive report of Aerodrome Finance (AERO) – 2025

Specter Intel

Company Overview

Aerodrome is an advanced automated market maker (AMM) operating on the Base Layer 2 blockchain, serving as its central liquidity hub. Launched on August 28, 2023, Aerodrome enhances liquidity provision, governance participation, and user experience by inheriting features from Velodrome V2.

The protocol employs a dual-token system:

– $AERO: An ERC-20 utility token distributed to liquidity providers as rewards.

– $veAERO: An ERC-721 governance token obtained by locking $AERO, granting voting power to influence emission distributions and entitling holders to a share of trading fees and additional incentives.

Aerodrome operates on a 7-day epoch cycle, during which emissions and rewards are calculated and distributed based on the votes each liquidity pool receives.

As of March 7, 2025, Aerodrome holds approximately 4% of Base’s total trading volume1 and ranks second in fees generated2 over the past 24 hours, 7 days, 30 days, and 1-year time frames. Its core function is to facilitate token swaps through deep liquidity, generating fees that reward both liquidity providers and veAERO voters.

Investment Overview

Meta DEX Model

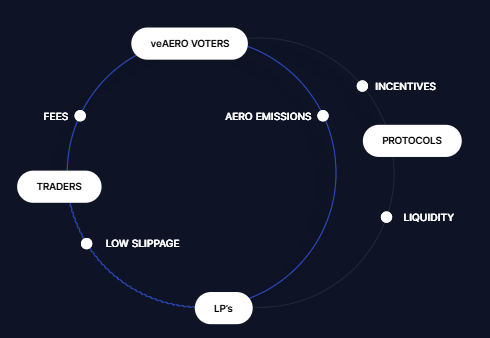

Aerodrome operates under a Meta DEX Model, which introduces four core innovations that significantly improve upon traditional decentralized exchanges (DEXs). This model enhances capital efficiency, incentivizes long-term participation, and optimizes liquidity distribution through a dynamic reward system.

- Liquidity Provision: Liquidity providers (LPs) deposit asset pairs into liquidity pools, facilitating seamless trading.

- Trading & Fees: Traders swap assets within these pools, generating fees that sustain the ecosystem.

- Voting & Emissions: veAERO holders vote for specific liquidity pools, directing emissions while earning trading fees and additional incentives.

- Incentive Structure: Liquidity emissions are subsidized not only by the protocol but also by external incentives, often provided by other protocols seeking deep liquidity for their assets.

This model aligns incentives across LPs, traders, and veAERO holders, creating a self-sustaining liquidity ecosystem that benefits all participants.

Tokenomics

Aerodrome’s AERO token is designed with some of the strongest tokenomics in the crypto space.

- Utility: AERO can be freely bought, sold, or traded on Aerodrome, used to incentivize liquidity pools, or locked to obtain veAERO, the protocol’s governance token.

- veAERO Mechanics: Locking AERO grants veAERO, which determines voting power and emissions influence. The longer the lock period, the greater the veAERO received:

- 1-year lock → 0.25 veAERO per AERO

- 4-year lock → 1 veAERO per AERO

- Governance: veAERO holders direct liquidity emissions, receive trading fees, and influence key protocol decisions.

- TGE: At the time of the Token Generation Event (TGE), 50% of the total AERO supply was max locked for four years. This locked supply remains at a perpetual four-year duration, further strengthening protocol security and reducing sell pressure.

Roughly 48% of the circulating supply of AERO is locked as veAERO.4 Fee APR for the flagship concentrated liquidity (CL) pool, CL100-WETH/USDC, is 43%.4 Additionally, the CL100-WETH-cbBTC pool has 55% APR, and the CL100-USDC/cbBTC pool’s is 62%.4 These pools also boast strong emission APR, 202%, 138%, and 110% respectively. Fee APR is volatile based on volume for the epoch, and emissions APR is dependent on votes received from veAERO voters.

Risks

Emissions

Emissions are a central part of the Aerodrome Meta Dex Model, but they come at a cost to token holders. As of the current epoch (80), just under 10 million AERO was added to the circulating supply through veAERO rebases and rewards for staked liquidity positions.

Single Chain Reliance

Aerodrome, contrary to its parent Velodrome, only operates on Base. Base has proved itself to be one of the strongest layer 2s built on Ethereum, but it faces intense competition from other layer 2s, like Arbitrum and Optimism. It also contends with layer 1s, like Solana and BNB Chain. Being limited to a single chain may hinder potential long-term growth. However, with Coinbase being directly involved in Base, and their plans to rapidly expand towards decentralization could be pivotal in Aerodrome’s success.

Conclusion

Based on conducted research, we believe AERO is a BUY*. Its strong tokenomics and attractive Meta DEX model make it a better option for liquidity providers and veAERO lockers compared to competitors. It features no venture capital or inside holders, meaning there is no internal sell pressure. Strong APR percentages are another key reason for Aerodrome’s success, as it attracts deep levels of liquidity, resulting in low slippage trades. High trading volume brings in high levels of fees, which are returned 100% to veAERO voters.

Relevant Sources:

- CoinMarketCap DEX Rankings: coinmarketcap.com

- DeFiLlama Base Chain Fees: defillama.com

- Aerodrome Finance Documentation: aerodrome.finance

- Aerodrome Protocol Metrics by 0xkhmer: dune.com