A comprehensive report of Venice AI (VVV) – 2025

Specter Intel

Company Overview

Venice AI is a next-generation AI service that combines privacy with the power of Artificial Intelligence. Users, developers, and AI agents can access multiple AI models without the risk of their data being sold to third parties. Venice is open-source, compatible with the OpenAI API, and offers a variety of features¹.

Users can chat, generate images, get help with code, transcribe audio, analyze documents, interact with characters created on the platform, and more¹.

The Venice token, VVV, is used by stakers who control the inference capacity of the Venice platform through the Venice API. Stakers also earn a yield on their staked balance, currently 59% APY¹.

The Venice API operates differently from traditional APIs. It allows users to query data without paying per request. Instead, users stake VVV and earn a VCU balance, which can be used daily. Once the balance is depleted, users must wait for the next epoch or stake additional tokens. For those who prefer traditional pay-per-request usage, that option is also available¹.

Investment Overview

Privacy Focus

Venice prides itself on being privacy-first. “Every message you send to ChatGPT (or Gemini, or Anthropic, or Perplexity, or Grok…) is stored forever—to be reviewed, to be classified, to be sold, to be hacked, to be granted to any government that cares to request it”². In contrast, Venice does not store user data and accesses models privately and securely. This creates a competitive advantage, as privacy-conscious users who wish to avoid having their data sold to corporations like OpenAI and Google will be more likely to choose Venice.

Unique API

The Venice API offers a distinctive feature set that appeals to both developers and investors. Stakers gain access to premium features by staking VVV, receiving roughly 60% APY in addition to full access to the API. Key features include chat requests, image generation, audio transcription, and the analysis of documents, photos, and other media formats. Users who stake tokens receive a VCU balance, which regulates both daily AI inference limits and staking yields. VCUs represent a portion of Venice’s computing capacity and serve as the unit through which requests to the Venice API are made. Users may also pay in USD to access the API traditionally, though this method forfeits staking yields.

Tokenomics

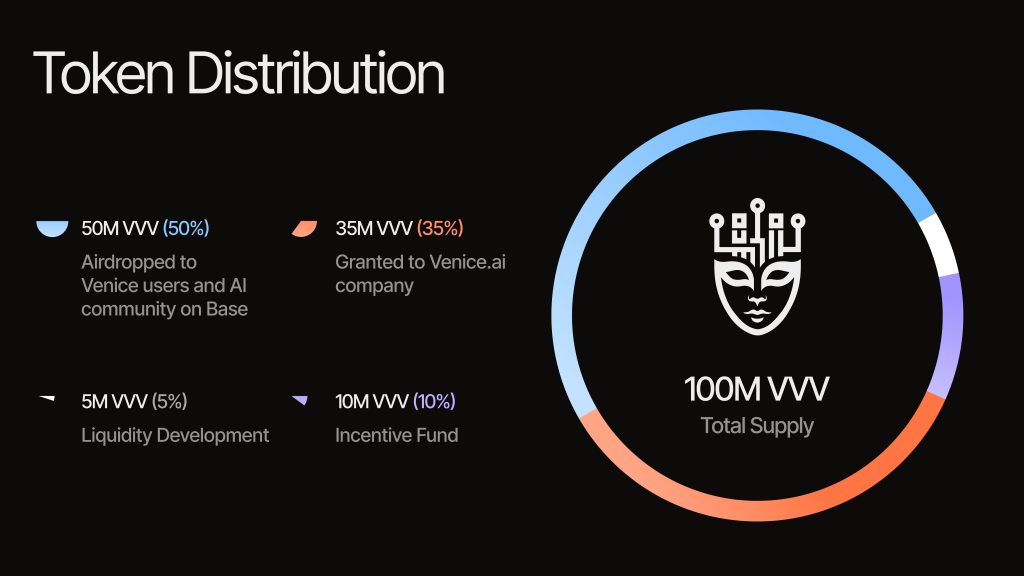

VVV was initially airdropped to a wide range of crypto users. Roughly 50% of the token supply was allocated at the Token Generation Event (TGE), with the remainder reserved primarily for staking rewards, which emit 14 million VVV annually. There was no presale, no governance, and the initial supply was 100 million VVV.

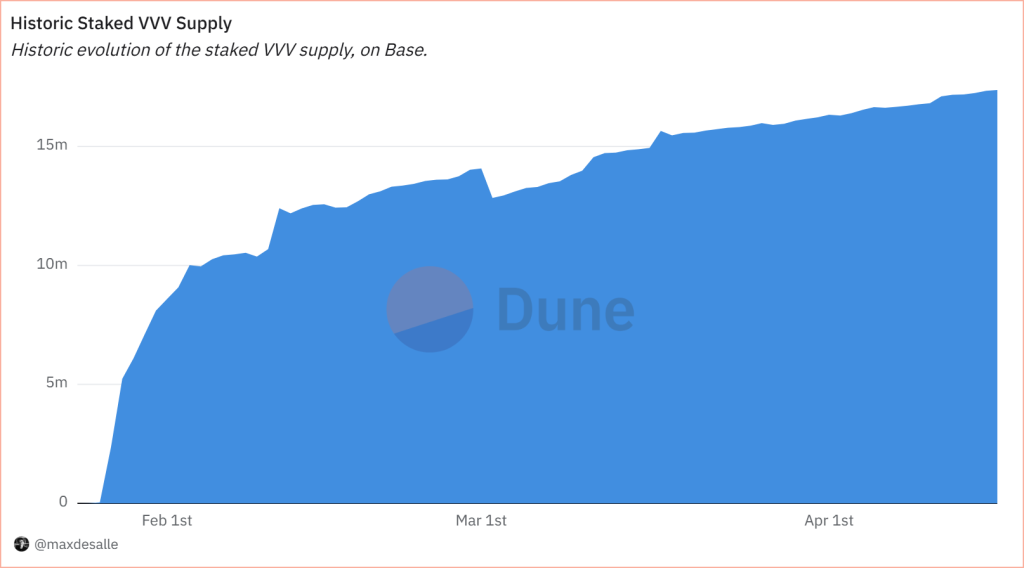

As of April 24, 2025, approximately 17.3 million VVV is staked, representing 15.88% of the total supply³. The staked supply has grown consistently since the TGE in January 2025. Roughly 65% of the supply allocated to airdrop recipients was unclaimed and was recently burned.

Risks

Negative Initial Sentiment

VVV’s TGE was turbulent, with the token price surging from mere cents to over twenty dollars before falling below two dollars within a few months. While this was partly due to broader market conditions, increased sell pressure resulted from mass sell-offs by airdrop recipients. Furthermore, the listing of VVV on Aerodrome—the largest DEX on Base—was allegedly sniped by insiders, which negatively impacted investor sentiment and fostered mistrust around the launch. This issue has since been addressed and resolved by the teams involved.

Emissions

Emissions will begin at 14 million tokens annually and will decrease over time. The rate of new token issuance will also be influenced by demand for VVV, which is justified by its staking utility².

Conclusion

Based on conducted research, we believe that VVV is a BUY*. In a rapidly evolving world dominated by AI, the need for privacy is more critical than ever. VVV’s combination of staking yield and API access makes it highly attractive to developers, traders, and AI-based applications. As global AI demand continues to rise, Venice is well-positioned to capture market share from larger players like ChatGPT, Gemini, and others.

Relevant Sources:

Venice Documentation: docs.venice.ai

Venice Intro: venice.ai

Venice Dune Dashboard: dune.com